506 II f/cA',\^1„..

26 USC 38 note.

Ante, p. 503.

PUBLIC LAW 92-178-DEC. 10, 1971

[85 STAT.

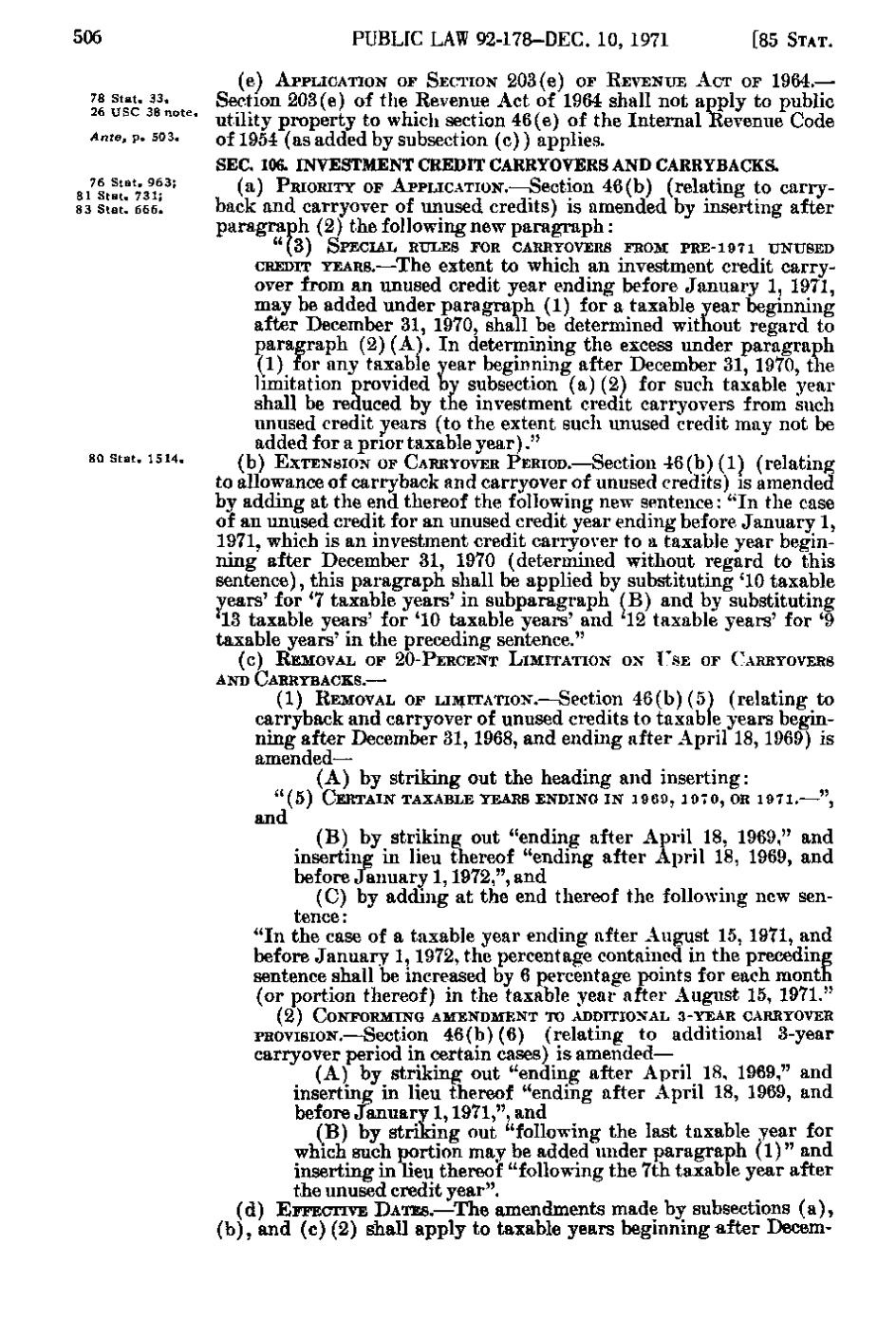

(e) APPLICATION OF SECTION 203(e) OF REVENUE ACT OF 1964.— Section 203(e) of the Revenue Act of 1964 shall not apply to public utility property to which section 46(e) of the Internal Revenue Code of 1954 (as added by subsection (c)) applies.

SEC. 1 6 INVESTMENT CREDIT CARRYOVERS AND CARRYBACKS. 0. i^starVa^i"' 3 Stat! 666^

^^) PRIORITY OF APPLICATION.—Section 46(b) (relating to carrybaclv and carryover of unused credits) is amended by inserting after paragraph (2) the following new paragraph: "(3)

80 Stat. 1514.

SPECIAL RULES FOR CARRYOVERS FROM PRE-I9 7 I

UNUSED

CREDIT YEARS.—The extent to which an investment credit carryover from an unused credit year ending before January 1, 1971, may be added under paragraph (1) for a taxable year beginning after December 31, 1970, shall be determined without regard to paragraph (2)(A). In determining the excess under paragraph (1) for any taxable year beginning after December 31, 1970, the limitation provided by subsection (a)(2) for such taxable year shall be reduced by the investment credit carryovers from such unused credit years (to the extent such unused credit may not be added for a prior taxable year)." (|3^ EXTENSION OF CARRYOVER PERIOD.—Section 46(b)(1) (relating to allowance of carryback and carryover of unused credits) is amended by adding at the end thereof the following new sentence: " I n the case of an unused credit for an unused credit year ending before January 1, 1971, which is an investment credit carryover to a taxable year beginning after December 31, 1970 (determined without regard to this sentence), this paragraph shall be applied by substituting '10 taxable years' for '7 taxable years' in subparagraph (B) and by substituting '13 taxable years' for '10 taxable years' and '12 taxable years' for '9 taxable years' in the preceding sentence." (c) REMOVAL OF 20-PERCENT LIMITATION AND C A R R Y B A C K S. —

ON L^SE OF CARRYOVERS

(1) REMOVAL OF LIMITATION.—Section 4 6 (b)(5) (relating to

carryback and carryover of unused credits to taxable years beginning after December 31, 1968, and ending after April 18, 1969) is amended— (A) by striking out the heading and inserting: "(5)

CERTAIN TAXABLE YEARS E N D I N G I N I 9 6 9, IOTO, OR I Q T I. — ",

and (B) by striking out "ending after April 18, 1969," and inserting in lieu thereof "ending after April 18, 1969, and before January 1, 1972,", and (C) by adding at the end thereof the following new sentence: " I n the case of a taxable year ending after August 15, 1971, and before January 1, 1972, the percentage contained in the preceding sentence shall be increased by 6 percentage points for each month (or portion thereof) in the taxable year after August 15, 1971." (2)

CONFORMING AMENDMENT TO ADDITIONAL 3-YEAR CARRYOVER

PROVISION.—Section 46(b)(6) (relating to additional 3-year carryover period in certain cases) is amended— (A) by striking out "ending after April 18, 1969," and inserting in lieu thereof "ending after April 18, 1969, and before January 1, 1971,", and (B) by striking out "following the last taxable year for which such portion may be added under paragraph (1) " and inserting in lieu thereof "following the 7th taxable year after the unused credit year". (d) EFFECTIVE DATES.—The amendments made by subsections (a), (b), and (c)(2) shall apply to taxable years beginning after Decern-

�