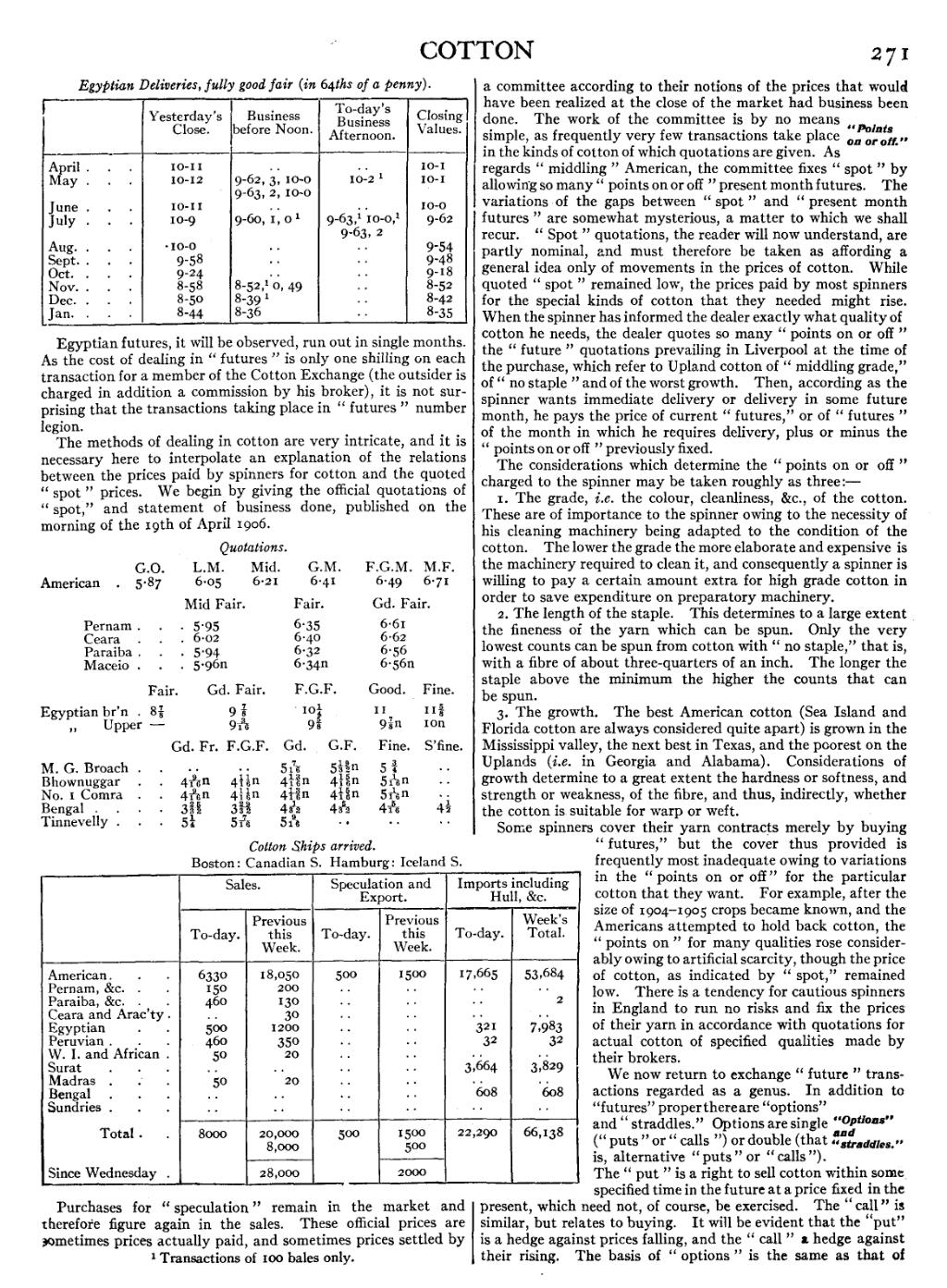

Egyptian Deliveries, fully good fair (in 64ths of a penny).

| Yesterday’s Close. |

Business before Noon. | To-day’s Business Afternoon. |

Closing Values. | |

| April | 10-11 | · · | · · | 10-1 |

| May | 10-12 | 9-62, 3, 10-0 | 10-2[1] | 10-1 |

| 9-63, 2, 10-0 | ||||

| June | 10-11 | · · | · · | 10-0 |

| July | 10-9 | 9-60, 1, 0[1] | 9-63,[1] 10-0, [1] | 9-62 |

| 9-63, 2 | ||||

| Aug. | 10-0 | · · | · · | 9-54 |

| Sept. | 9-58 | · · | · · | 9-48 |

| Oct. | 9-24 | · · | · · | 9-18 |

| Nov. | 8-58 | 8-52,[1] 0, 49 | · · | 8-52 |

| Dec. | 8-50 | 8-39[1] | · · | 8-42 |

| Jan. | 8-44 | 8-36 | · · | 8-35 |

Egyptian futures, it will be observed, run out in single months. As the cost of dealing in “futures” is only one shilling on each transaction for a member of the Cotton Exchange (the outsider is charged in addition a commission by his broker), it is not surprising that the transactions taking place in “futures” number legion.

The methods of dealing in cotton are very intricate, and it is necessary here to interpolate an explanation of the relations between the prices paid by spinners for cotton and the quoted “spot” prices. We begin by giving the official quotations of “spot,” and statement of business done, published on the morning of the 19th of April 1906.

| Quotations. | ||||||

| G.O. | L.M. | Mid. | G.M. | F.G.M. | M.F. | |

| American | 5.87 | 6.05 | 6.21 | 6.41 | 6.49 | 6.71 |

| Mid Fair. | Fair. | Gd. Fair. | |

| Pernam | 5.95 | 6.35 | 6.61 |

| Ceara | 6.02 | 6.40 | 6.62 |

| Paraiba | 5.94 | 6.32 | 6.56 |

| Maceio | 5.96n | 6.34n | 6.56n |

| Fair. | Gd. Fair. | F.G.F. | Good. | Fine. | |

| Egyptian br’n | 878 | 978 | 1014 | 11 | 1158 |

| Egyptian Upper | — | 9316 | 958 | 978n | 10n |

| Gd. Fr. | F.G.F. | Gd. | G.F. | Fine. | S’fine. | |

| M. G. Broach. | · · | · · | 5716 | 51932 | 534 | · · |

| Bhownuggar | 4916n | 41116n | 41316n | 41516n | 5116n | · · |

| No. 1 Comra | 4916n | 41116n | 41316n | 41516n | 5116n | · · |

| Bengal | 32532 | 32932 | 4132 | 4532 | 4516 | 412 |

| Tinnevelly | 514 | 5716 | 5916 | · · | · · | · · |

Cotton Ships arrived.

Boston: Canadian S. Hamburg: Iceland S.

| Sales. | Speculation and Export. | Imports including Hull, &c. | ||||

| To-day. | Previous this Week. |

To-day. | Previous this Week. |

To-day. | Week’s Total. | |

| American | 6330 | 18,050 | 500 | 1500 | 17,665 | 53,684 |

| Pernam, &c. | 150 | 200 | · · | · · | · · | · · |

| Paraiba, &c. | 460 | 130 | · · | · · | · · | 2 |

| Ceara and Arac’ty | · · | 30 | · · | · · | · · | · · |

| Egyptian | 500 | 1200 | · · | · · | 321 | 7,983 |

| Peruvian | 460 | 350 | · · | · · | 32 | 32 |

| W. I. and African | 50 | 20 | · · | · · | · · | · · |

| Surat | · · | · · | · · | · · | 3,664 | 3,829 |

| Madras | 50 | 20 | · · | · · | · · | · · |

| Bengal | · · | · · | · · | · · | 608 | 608 |

| Sundries | · · | · · | · · | · · | · · | · · |

| Total | 8000 | 20,000 | 500 | 1500 | 2,290 | 66,138 |

| 8,000 | 500 | |||||

| Since Wednesday | 28,000 | 2000 | ||||

Purchases for “speculation” remain in the market and

therefore figure again in the sales. These official prices are

sometimes prices actually paid, and sometimes prices settled by

a committee according to their notions of the prices that would

“Points

on or off.”

have been realized at the close of the market had business been

done. The work of the committee is by no means

simple, as frequently very few transactions take place

in the kinds of cotton of which quotations are given. As

regards “middling” American, the committee fixes “spot” by

allowing so many “points on or off” present month futures. The

variations of the gaps between “spot” and “present month

futures” are somewhat mysterious, a matter to which we shall

recur. “Spot” quotations, the reader will now understand, are

partly nominal, and must therefore be taken as affording a

general idea only of movements in the prices of cotton. While

quoted “spot” remained low, the prices paid by most spinners

for the special kinds of cotton that they needed might rise.

When the spinner has informed the dealer exactly what quality of

cotton he needs, the dealer quotes so many “points on or off”

the “future” quotations prevailing in Liverpool at the time of

the purchase, which refer to Upland cotton of “middling grade,”

of “no staple” and of the worst growth. Then, according as the

spinner wants immediate delivery or delivery in some future

month, he pays the price of current “futures,” or of “futures”

of the month in which he requires delivery, plus or minus the

“points on or off” previously fixed.

The considerations which determine the “points on or off” charged to the spinner may be taken roughly as three:—

1. The grade, i.e. the colour, cleanliness, &c., of the cotton. These are of importance to the spinner owing to the necessity of his cleaning machinery being adapted to the condition of the cotton. The lower the grade the more elaborate and expensive is the machinery required to clean it, and consequently a spinner is willing to pay a certain amount extra for high grade cotton in order to save expenditure on preparatory machinery.

2. The length of the staple. This determines to a large extent the fineness of the yarn which can be spun. Only the very lowest counts can be spun from cotton with “no staple,” that is, with a fibre of about three-quarters of an inch. The longer the staple above the minimum the higher the counts that can be spun.

3. The growth. The best American cotton (Sea Island and Florida cotton are always considered quite apart) is grown in the Mississippi valley, the next best in Texas, and the poorest on the Uplands (i.e. in Georgia and Alabama). Considerations of growth determine to a great extent the hardness or softness, and strength or weakness, of the fibre, and thus, indirectly, whether the cotton is suitable for warp or weft.

Some spinners cover their yarn contracts merely by buying “futures,” but the cover thus provided is frequently most inadequate owing to variations in the “points on or off” for the particular cotton that they want. For example, after the size of 1904–1905 crops became known, and the Americans attempted to hold back cotton, the “points on” for many qualities rose considerably owing to artificial scarcity, though the price of cotton, as indicated by “spot,” remained low. There is a tendency for cautious spinners in England to run no risks and fix the prices of their yarn in accordance with quotations for actual cotton of specified qualities made by their brokers.

We now return to exchange “future” transactions regarded as a genus. In addition to “futures” proper there are “options” and “straddles.” Options are single (“puts” or “calls”) or double (that “Options” and “straddles.” is, alternative “puts” or “calls”). The “put” is a right to sell cotton within some specified time in the future at a price fixed in the present, which need not, of course, be exercised. The “call” is similar, but relates to buying. It will be evident that the “put” is a hedge against prices falling, and the “call” a hedge against their rising. The basis of “options” is the same as that of