Chapter 13

Appropriations

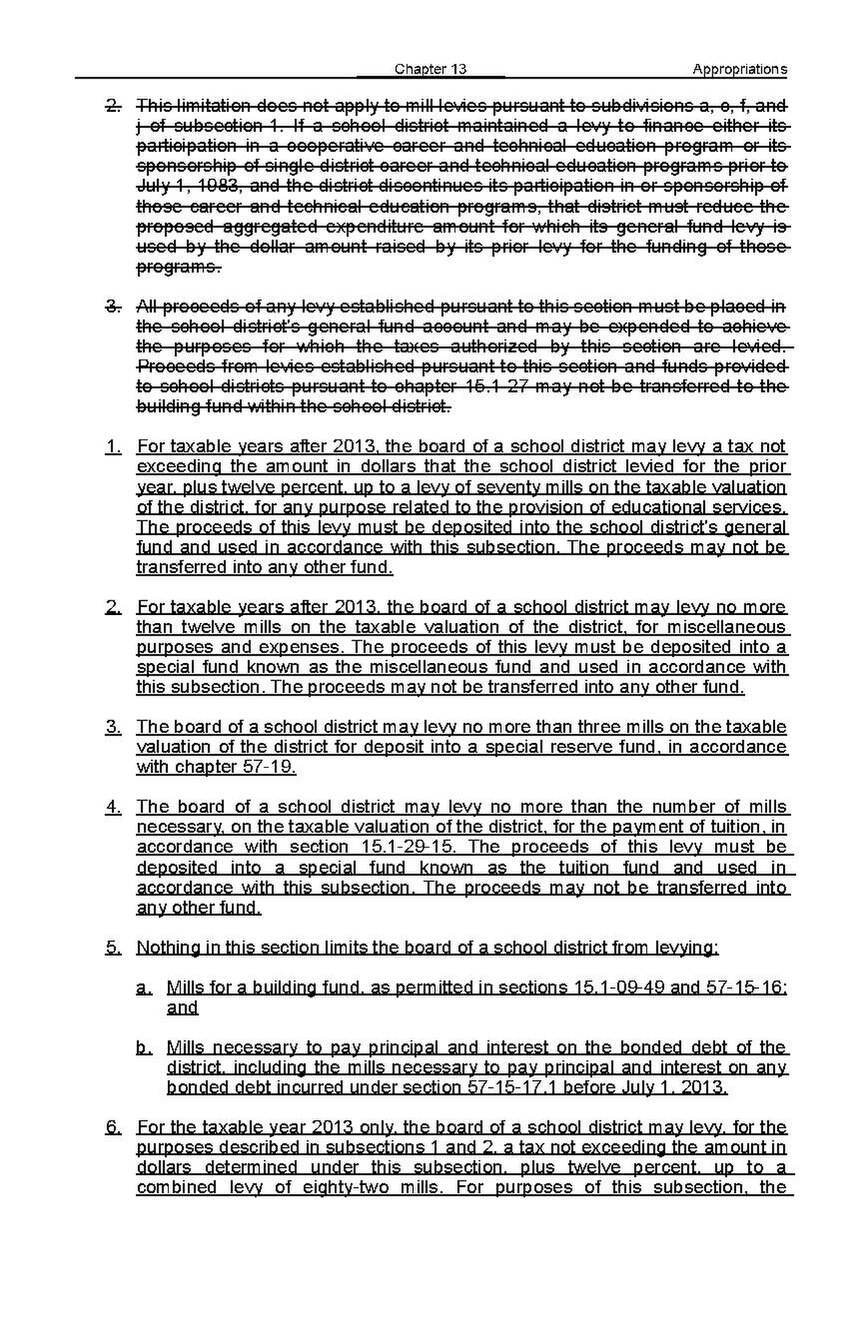

2. This limitation does not apply to mill levies pursuant to subdivisions a, c, f, and j of subsection 1. If a school district maintained a levy to finance either its participation in a cooperative career and technical education program or its sponsorship of single-district career and technical education programs prior to July 1, 1983, and the district discontinues its participation in or sponsorship of those career and technical education programs, that district must reduce the proposed aggregated expenditure amount for which its general fund levy is used by the dollar amount raised by its prior levy for the funding of those programs. 3. All proceeds of any levy established pursuant to this section must be placed in the school district's general fund account and may be expended to achieve the purposes for which the taxes authorized by this section are levied. Proceeds from levies established pursuant to this section and funds provided to school districts pursuant to chapter 15.1-27 may not be transferred to the building fund within the school district. 1. For taxable years after 2013, the board of a school district may levy a tax not exceeding the amount in dollars that the school district levied for the prior year, plus twelve percent, up to a levy of seventy mills on the taxable valuation of the district, for any purpose related to the provision of educational services. The proceeds of this levy must be deposited into the school district's general fund and used in accordance with this subsection. The proceeds may not be transferred into any other fund. 2. For taxable years after 2013, the board of a school district may levy no more than twelve mills on the taxable valuation of the district, for miscellaneous purposes and expenses. The proceeds of this levy must be deposited into a special fund known as the miscellaneous fund and used in accordance with this subsection. The proceeds may not be transferred into any other fund. 3. The board of a school district may levy no more than three mills on the taxable valuation of the district for deposit into a special reserve fund, in accordance with chapter 57-19. 4. The board of a school district may levy no more than the number of mills necessary, on the taxable valuation of the district, for the payment of tuition, in accordance with section 15.1-29-15. The proceeds of this levy must be deposited into a special fund known as the tuition fund and used in accordance with this subsection. The proceeds may not be transferred into any other fund. 5. Nothing in this section limits the board of a school district from levying: a. Mills for a building fund, as permitted in sections 15.1 -09-49 and 57-15-16; and b. Mills necessary to pay principal and interest on the bonded debt of the district, including the mills necessary to pay principal and interest on any bonded debt incurred under section 57-15-17.1 before July 1, 2013. 6. For the taxable year 2013 only, the board of a school district may levy, for the purposes described in subsections 1 and 2, a tax not exceeding the amount in dollars determined under this subsection, plus twelve percent, up to a combined levy of eighty-two mills. For purposes of this subsection, the