Chapter 13

Appropriations

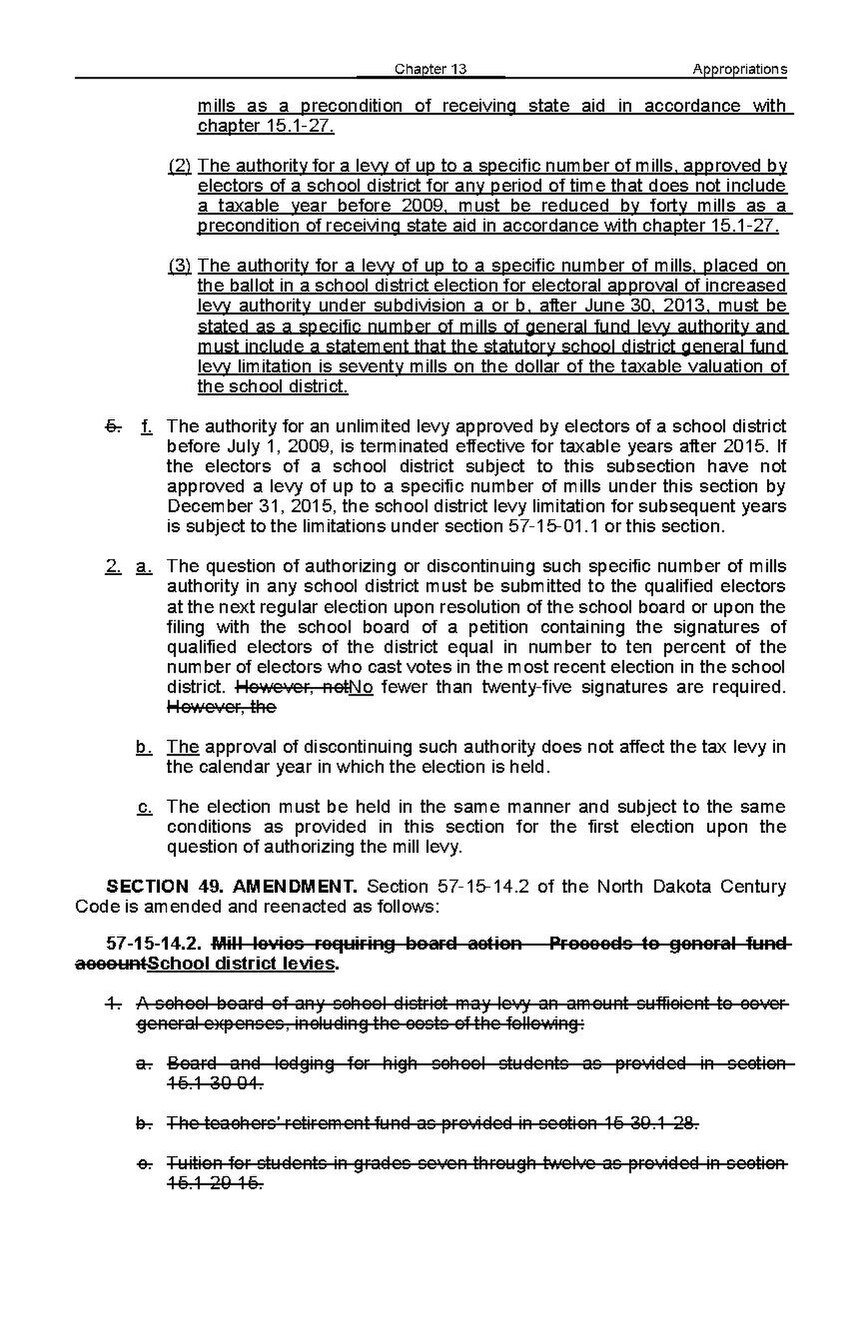

mills as a precondition of receiving state aid in accordance with chapter 15.1-27. (2) The authority for a levy of up to a specific number of mills, approved by electors of a school district for any period of time that does not include a taxable year before 2009, must be reduced by forty mills as a precondition of receiving state aid in accordance with chapter 15.1-27. (3) The authority for a levy of up to a specific number of mills, placed on the ballot in a school district election for electoral approval of increased levy authority under subdivision a or b, after June 30, 2013, must be stated as a specific number of mills of general fund levy authority and must include a statement that the statutory school district general fund levy limitation is seventy mills on the dollar of the taxable valuation of the school district. 5.

f. The authority for an unlimited levy approved by electors of a school district before July 1, 2009, is terminated effective for taxable years after 2015. If the electors of a school district subject to this subsection have not approved a levy of up to a specific number of mills under this section by December 31, 2015, the school district levy limitation for subsequent years is subject to the limitations under section 57-15-01.1 or this section.

2. a. The question of authorizing or discontinuing such specific number of mills authority in any school district must be submitted to the qualified electors at the next regular election upon resolution of the school board or upon the filing with the school board of a petition containing the signatures of qualified electors of the district equal in number to ten percent of the number of electors who cast votes in the most recent election in the school district. However, notNo fewer than twenty-five signatures are required. However, the b. The approval of discontinuing such authority does not affect the tax levy in the calendar year in which the election is held. c. The election must be held in the same manner and subject to the same conditions as provided in this section for the first election upon the question of authorizing the mill levy. SECTION 49. AMENDMENT. Section 57-15-14.2 of the North Dakota Century Code is amended and reenacted as follows: 57-15-14.2. Mill levies requiring board action - Proceeds to general fund accountSchool district levies. 1. A school board of any school district may levy an amount sufficient to cover general expenses, including the costs of the following: a. Board and lodging for high school students as provided in section 15.1-30-04. b. The teachers' retirement fund as provided in section 15-39.1-28. c. Tuition for students in grades seven through twelve as provided in section 15.1-29-15.